China´s secrecy loans and Venezuela: A new strategic relationship?

Source: Reuters

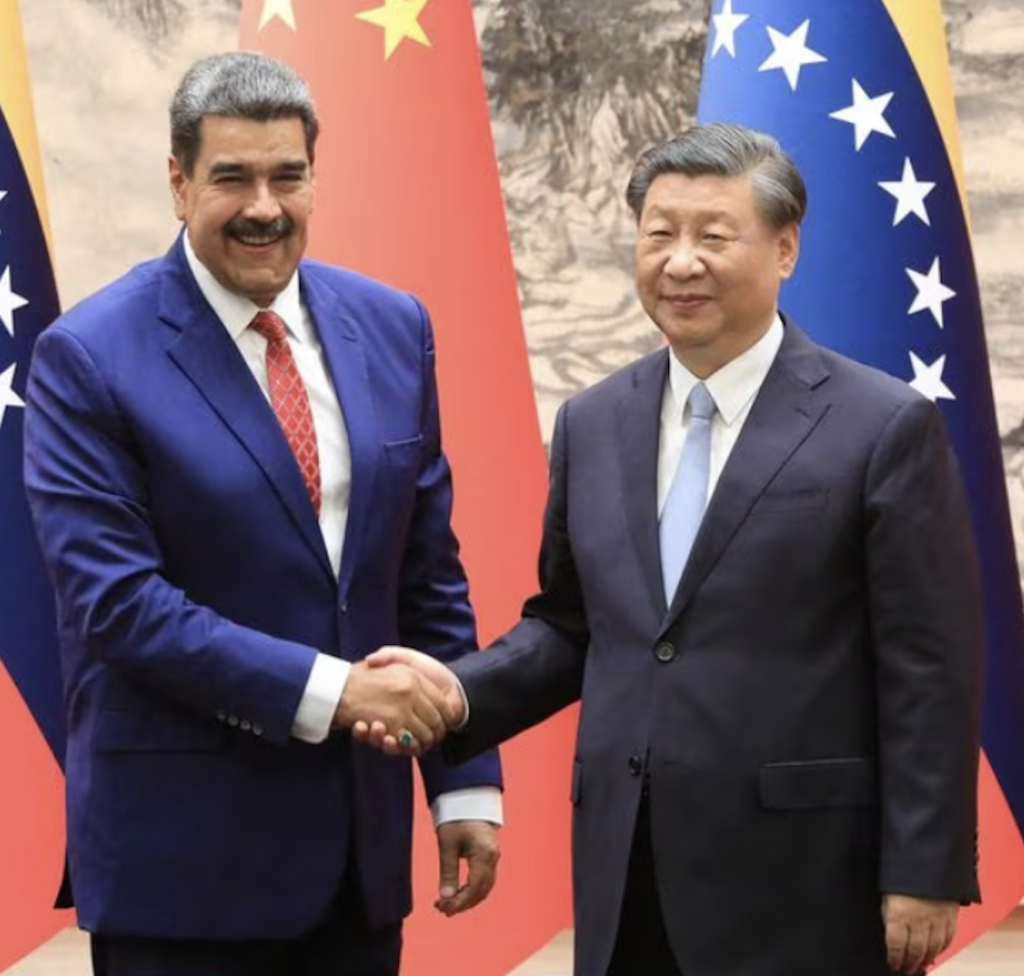

On September 13, 2023, President Xi Jinping declared that China and Venezuela would elevate their ties to an “all-weather strategic partnership.” This move, reminiscent of China’s approach with Pakistan, transcends mere economic cooperation, extending into a full-fledged alliance encompassing military coordination. Consequently, this announcement marked a significant upgrade in the China-Venezuela relationship.

To grasp the implications of this newfound alliance, it’s essential to consider two key factors: the troubled history of Sino-Venezuelan relations and the geopolitical significance of Venezuela, particularly its abundant natural resources.

Sino-Venezuelan Relations: When Things Take a Turn for the Worse

According to the China-Latin America Finance Database, compiled by The Dialogue and Boston University’s Global Development Policy Center, Venezuela has been the favored Latin American nation for receiving development loans, accounting for nearly half of the total funds disbursed until 2022. Venezuela has received loans amounting to $60 billion, with the lion’s share, approximately $50.3 billion, allocated through two mechanisms: Joint Funds and the Long-Term Facility.

These loans were structured around a collaborative governance model, wherein China and Venezuela (via the China Development Bank and the Venezuelan National Bank of Economic and Social Development) were responsible for financing eligible projects to promote development. While these loans lacked collateral, China protected debt repayment through a petroleum sale and purchase contract, obliging PDVSA to supply oil to the China National Petroleum Corporation (CNPC). The initial loan agreement was inked in 2008, during the peak of Chávez’s popularity and regional leadership, when PDVSA was producing 3.118.5 thousand barrels per day.

However, the situation took a downturn. Chávez dismantled the rule of law, eroded PDVSA’s autonomy, and fostered unsustainable debt accumulation. The inflow of petrodollars and the disbursal of debt were marred by rampant corruption. By 2014, it became evident that the chavista era’s extravagant party was over. In 2015, China reluctantly renewed one of the Joint Fund credits for the last time, beginning a complicated restructuring process the following year. Venezuela not only mishandled the loan disbursements, leaving many projects unfinished but also accumulated an outstanding debt estimated at $19 billion by 2018.

For China, Venezuela is a cautionary tale rather than a shining example of the merits of the Belt and Road Initiative. Instead of fostering development, China’s loans facilitated kleptocracy. Despite China’s considerable supervisory authority, it could not prevent the mismanagement of loans and the deterioration of the oil industry. Owing to China’s opacity, there is no public information on the administration of these loans. However, the limited information available strongly suggests gross mismanagement.

When China grappled with debt collection, Maduro struck a deal with the U.S. government, granting Chevron special oil rights to settle its debt with PDVSA. This indicated a shift in Venezuela’s preferences toward the West, with reports suggesting that a relaxation of sanctions could further increase U.S. involvement in Venezuela’s oil sector—unwelcome news for China.

Venezuelan Geopolitical Interests

While Chevron engaged in oil activities in Venezuela, China, with the support of Brazil, promoted the BRICS initiative to create an expanded alliance. In this context, Maduro journeyed to China to formalize the “all-weather strategic partnership” agreement.

Once again, secrecy shrouds the precise details of this new partnership. However, it is reasonable to infer that the era of billion-dollar loans has concluded. China’s strategic interest lies in debt collection (with an estimated outstanding of $10 billion) and in erecting barriers to Western oil firms’ expansion in Venezuela.

Instead of injecting fresh funds to alleviate the humanitarian crisis, we can anticipate modest agreements that, mirroring the Chevron model, enhance China’s role in the oil industry, securing a stable oil supply at a time when the Western world is pushing to curtail oil projects. With Bolivia’s lithium and Venezuela’s oil, China can solidify its strategic position in Latin America while obstructing further U.S. influence.

New Oil Agreements: The Extractive Secrecy

In the short term, we can expect more oil agreements to further the de facto privatization of Venezuela’s oil industry. PDVSA is a bankrupted corporation incapable of financing the industry’s capital needs. The only viable option is to promote private investment. Since 2018, this privatization policy has encouraged informality and, once again, corruption. The new PDVSA leadership has chosen to end this state of affairs by fostering alliances with formal entities, including Chevron and, naturally, CNPC.

Consequently, we can anticipate oil agreements that transfer exploration, production, and commercialization rights to private firms. Given the de facto nature of this process, these agreements do not adhere to the fundamental principles of transparency and accountability. The opacity of this oil agreement is not only a Chinese imposition: Even today, there is no public information about the oil agreements between Chevron and PDVSA. Also, there is no public information about the oil revenues that Maduro is collecting and how those incomes are used. With the new China oil agreements, more secrecy could be anticipated.

The extractive industries, owing to their significant socio-environmental impact and the fiscal implications of oil revenues that can encourage rent-seeking behaviors, must be held to rigorous transparency standards. Consequently, it becomes imperative to advocate for transparency in the context of these new oil agreements. Nevertheless, it’s worth noting that, especially in the case of China, achieving this transparency may prove an exceedingly daunting challenge.